Quantitative finance interviews test candidates’ skills in probability, statistics, and stochastic calculus, requiring practical problem-solving and project-based research to excel in roles like sell-side or buy-side quants․

1․1 Understanding the Role of a Quantitative Finance Professional

Quantitative finance professionals apply mathematical models to analyze markets, manage risk, and optimize portfolios․ Roles include sell-side and buy-side quants, requiring expertise in programming, data analysis, and problem-solving․ Their work involves practical research and real-world applications, ensuring they stay updated with industry trends and continuously develop their technical and analytical skills for success in the field․

1․2 Overview of the Interview Process for Quant Roles

The interview process for quant roles typically involves multiple rounds, including technical assessments, problem-solving exercises, and discussions on academic projects․ Candidates are evaluated on their analytical skills, ability to communicate complex ideas, and handle pressure effectively․

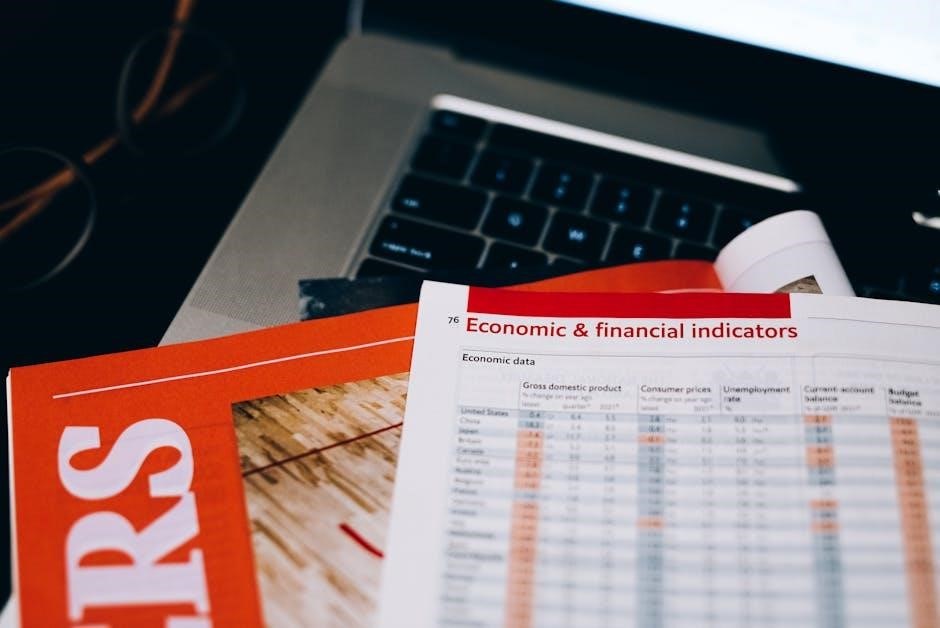

Core Concepts in Quantitative Finance

Quantitative finance relies heavily on probability, statistics, stochastic calculus, and time series analysis, forming the foundation for derivative pricing, risk management, and portfolio optimization strategies․

2․1 Probability and Statistics

Probability and statistics are foundational in quantitative finance, essential for understanding stochastic processes and data analysis․ Candidates should master concepts like distributions, hypothesis testing, and Bayesian statistics to tackle interview questions and real-world financial modeling challenges effectively․

2․2 Stochastic Calculus and Derivative Pricing

Stochastic calculus is crucial for derivative pricing and risk management․ Understanding Ito’s lemma, Brownian motion, and the Black-Scholes model is vital․ Candidates should practice solving problems involving option pricing and stochastic differential equations to excel in interviews and apply these concepts to real financial scenarios effectively․

2․3 Time Series Analysis

Time series analysis is essential for understanding financial data patterns․ Candidates should grasp concepts like ARIMA models and forecasting techniques․ Practical problem-solving in time series is critical, as it applies to real-world scenarios in finance, enabling effective data-driven decision-making and predictive analytics․

Technical Skills for Quant Interviews

Proficiency in programming languages like Python, R, and MATLAB is crucial․ Strong data analysis and visualization skills are essential for solving complex financial problems efficiently․

3․1 Programming Languages (Python, R, MATLAB)

Proficiency in Python, R, and MATLAB is essential for quantitative finance roles․ Python is widely used for its versatility in data analysis and machine learning․ R excels in statistical modeling, while MATLAB is preferred for complex numerical computations․ These languages are critical for developing algorithms, simulating financial models, and analyzing large datasets efficiently in quant roles․

3․2 Data Analysis and Visualization

Data analysis and visualization are critical skills in quantitative finance․ Candidates should be proficient in handling large datasets, performing statistical analyses, and creating clear visualizations․ Tools like Python’s Matplotlib, Seaborn, and R’s ggplot2 are essential for presenting complex financial data․ These skills help in identifying trends, communicating insights, and making data-driven decisions, which are vital for success in quant roles․

Behavioral and Soft Skills

Behavioral and soft skills are crucial in quant interviews․ Candidates must communicate complex ideas clearly and solve problems under pressure, demonstrating adaptability and teamwork in real-world scenarios․

4․1 Communicating Complex Ideas Clearly

Effectively conveying intricate financial concepts is vital․ Practice simplifying technical jargon, use real-world analogies, and structure your thoughts logically․ This ensures clarity and demonstrates your ability to articulate ideas persuasively, making complex topics accessible to both technical and non-technical audiences during interviews and beyond․

4․2 Problem-Solving Under Pressure

Quant interviews often include high-pressure scenarios to assess your ability to think critically and solve complex problems quickly․ Practice breaking down problems into manageable steps, using techniques like time series analysis, and leverage resources like “Heard on the Street” to refine your approach․ Stay calm, articulate your thought process, and demonstrate logical reasoning to impress interviewers․

Resources for Preparation

Key resources include books like “A Practical Guide To Quantitative Finance Interviews” and “Heard on the Street,” alongside online platforms for practice and research projects․

5․1 Recommended Books and Online Courses

Essential resources include “A Practical Guide To Quantitative Finance Interviews” and “Heard on the Street”, offering problem-solving insights․ Online courses in probability, linear algebra, and time series analysis are also vital for preparation․

5․2 Practice Platforms and Mock Interviews

Utilize platforms offering practice questions and mock interviews to refine your skills․ Simulating real-world scenarios helps build confidence and improves problem-solving under pressure, essential for success in quantitative finance interviews․

Common Interview Questions

Interviews often include academic and project-based questions, testing knowledge of probability, statistics, and stochastic calculus, as well as case studies to assess real-world application skills in finance․

6․1 Academic and Project-Based Questions

Interviews often focus on academic concepts like probability, statistics, and stochastic calculus, with questions requiring practical problem-solving․ Candidates may be asked to discuss their research projects, literature reviews, and the application of financial models․ A strong foundation in mathematical tools and the ability to articulate complex ideas clearly are essential for success in these types of questions․

6․2 Case Studies and Real-World Scenarios

Candidates are presented with real-world financial scenarios, such as portfolio optimization or risk management challenges․ They must apply theoretical knowledge to propose practical solutions․ Interviewers assess problem-solving skills, creativity, and the ability to handle pressure․ Simulating these scenarios during preparation helps build confidence and ensures readiness for high-stakes interviews in quantitative finance roles․

Interview Etiquette and Preparation

Research the firm and role thoroughly, simulate real interview scenarios, and practice communicating complex ideas clearly to build confidence and readiness for high-pressure situations․

7․1 Researching the Firm and Role

Understanding the firm’s culture, values, and specific quant role requirements is crucial․ Tailor your preparation by reviewing their focus areas, such as risk management or algorithmic trading, ensuring alignment with your skills and interests to stand out during interviews․

7․2 Simulating Interview Scenarios

Simulating real interview scenarios helps build confidence and clarity․ Practice answering technical and behavioral questions, focusing on clear communication and problem-solving under pressure․ Mock interviews with peers or mentors can provide valuable feedback, ensuring readiness for actual quant finance interviews․

Advanced Topics in Quantitative Finance

Explore machine learning in finance and risk management techniques․ These advanced topics highlight problem-solving scenarios, essential for modern quant roles, blending theoretical knowledge with practical applications․

8․1 Machine Learning Applications in Finance

Machine learning is revolutionizing finance through predictive modeling and algorithmic trading․ It enables quants to analyze large datasets, forecast market trends, and optimize portfolios efficiently․ Practical applications include risk management and sentiment analysis․

8․2 Risk Management and Portfolio Optimization

Risk management involves identifying and mitigating financial risks using techniques like Value at Risk (VaR) and stress testing․ Portfolio optimization focuses on balancing risk and return, employing Modern Portfolio Theory (MPT) and the Black-Litterman model․ These concepts are critical in quantitative finance, enabling professionals to create efficient investment strategies and manage risk effectively in dynamic markets․

Networking and Follow-Up

Networking and follow-up are crucial in the competitive quant finance industry․ Building connections provides insights and opportunities, while consistent communication ensures lasting impressions and further prospects․

9․1 Building Connections in the Industry

Building connections in the industry is vital for success in quantitative finance․ Attend conferences, join professional groups, and engage in online forums to meet professionals and gain insights․ Networking provides opportunities for mentorship, job referrals, and access to industry trends, which can be invaluable during your career journey․ Stay proactive and consistent in nurturing these relationships․

9․2 Post-Interview Communication

Effective post-interview communication is crucial․ Send a thank-you email within 24 hours, reiterating your interest in the role․ Follow up politely if you haven’t received a response within a week․ Maintain professionalism and brevity, ensuring your message is concise and appreciative․ This demonstrates your courtesy and enthusiasm, leaving a positive impression on the interviewers․

Final Tips for Success

Stay updated with industry trends and commit to continuous learning․ Regularly practice problem-solving and refine your programming skills to excel in quantitative finance interviews and beyond․

10․1 Staying Updated with Industry Trends

Stay informed about the latest developments in quantitative finance by following research papers, industry blogs, and subscribing to newsletters․ Engage with online communities and attend webinars to stay ahead․ Regularly review practical guides and resources to adapt to evolving trends and requirements in the field, ensuring you remain competitive and well-prepared for interviews and professional challenges․

10․2 Continuous Learning and Skill Development

Continuous learning is crucial in quantitative finance, as the field evolves rapidly․ Pursue advanced courses in programming, probability, and machine learning․ Regularly solve practice problems and engage in real-world projects to apply theoretical knowledge․ Stay curious and committed to improving your skills, ensuring you remain competitive and adaptable in the ever-changing landscape of quantitative finance and its applications․